PERFORMANCE (QEP)

QUALIFIED ELIGIBLE PERSONS ONLY

The Turk Capital U.S. Equity Long Short Strategy (the “Strategy”) is a managed futures program offered by an exclusive partnership between Turk Capital, LLC and TrimTabs Investment Research, Inc. Trading is based solely on the trading signals generated by the TrimTabs Demand Index (the “TTDI”). The TTDI is a proprietary regression model that uses 21 public and proprietary flow and sentiment variables for market timing. These variables are normalized into scores in order to create the TTDI and to generate signals for the Strategy. Based on levels of the TTDI, investors will benefit from one of four potential S&P 500 Future positions: 100% short, flat, 100% long or 200% long. The Strategy does not employ any other positions or use any other instruments. Investors benefit from TrimTabs’ unique focus on equity market liquidity—as opposed to fundamental or technical analysis—and the market timing signals this focus generates.

PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

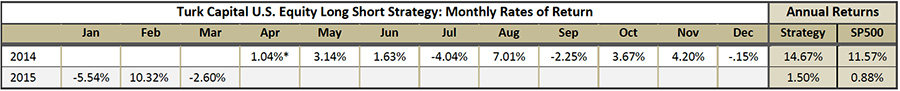

SP500 results are based on the SPY (SPDR S&P500 ETF). Results take into account a 1% Management and 20% Incentive Fees as well as actual execution costs.*Results from April 2014 are from a proprietary trading account and are inclusive of pro forma fees. Net performance is not reduced by commissions on open positions for rate of return calculations. ROR is calculated in accordance with the Modified OAT method. Accounts opening or closing during a month are generally excluded from ROR calculations.

SP500 results are based on the SPY (SPDR S&P500 ETF). Results take into account a 1% Management and 20% Incentive Fees as well as actual execution costs.*Results from April 2014 are from a proprietary trading account and are inclusive of pro forma fees. Net performance is not reduced by commissions on open positions for rate of return calculations. ROR is calculated in accordance with the Modified OAT method. Accounts opening or closing during a month are generally excluded from ROR calculations.

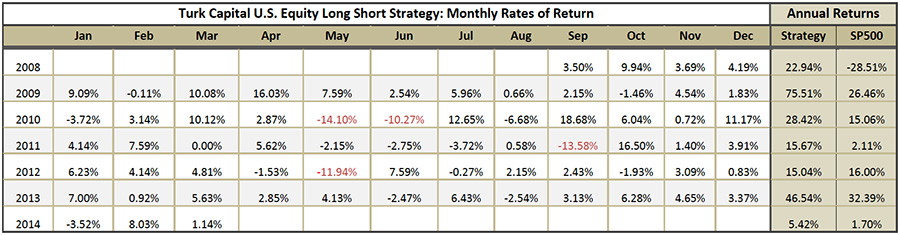

TrimTabs has been generating trading signals based on the Demand Index since September 3, 2008. The following hypothetical results are calculated by adjusting trading results that would have been realized for fees since September 3, 2008.

All results are based on the SPY (SPDR S&P500 ETF). Sharpe Ratio calculations include back tested performance data from 2008. Results are based off of 1% Management and 20% Incentive Fees as well as .20 % p.a. execution costs. Hypothetical performance assumes trades are executed at a price equal to the average of the volume weighted average price on the day the signal would have been received and the prior day’s closing price.

All results are based on the SPY (SPDR S&P500 ETF). Sharpe Ratio calculations include back tested performance data from 2008. Results are based off of 1% Management and 20% Incentive Fees as well as .20 % p.a. execution costs. Hypothetical performance assumes trades are executed at a price equal to the average of the volume weighted average price on the day the signal would have been received and the prior day’s closing price.

Sharpe Ratio: 1.55 (.37 for the SP500). Worst Monthly Loss:-14.10% (-16.66% SP500). Largest Drawdown: -22.92% (-29.89% SP500).

PURSUANT TO AN EXEMPTION FROM THE COMMODITY FUTURES TRADING COMMISSION IN CONNECTION WITH ACCOUNTS OF QUALIFIED ELIGIBLE PERSONS, THIS BROCHURE OR ACCOUNT DOCUMENT IS NOT REQUIRED TO, AND HAS NOT BEEN, FILED WITH THE COMMISSION. THE COMMODITY FUTURES TRADING COMMSSION DOES NOT PASS UPON THE MERITS OF PARTICIPATING IN A TRADING PROGRAM OR UPON THE ADEQUACY OR ACCURACY OF COMMODITY TRADING ADVISOR DISCLOSURE. CONSEQUENTLY, THE COMMODITY FUTURES TRADING COMMISSION HAS NOT REVIEWED OR APPROVED THIS TRADING PROGRAM OR THIS BROCHURE OR THIS ACCOUNT DOCUMENT. THIS IS NOT AN OFFERING OR THE SOLICIATION OF AN OFFER TO INVEST IN THE TURK CAPITAL U.S. EQUITY LONG SHORT STRATEGY. ANY SUCH OFFER OR SOLICITATION WILL ONLY BE MADE TO QUALIFIED INVESTORS BY MEANS OF AN INVESTMENT MANAGEMENT AGREEMENT AND ONLY WHERE ALLOWED BY APPLICABLE LAW. AN INVESTMENT IN THE STRATEGY IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK.

THE PERFORMANCE INFORMATION HAS NOT BEEN INDEPENDENTLY VERIFIED BUT IT IS BELIEVED BY TURK CAPITAL, LLC TO BE CORRECT.

The Turk Capital U.S. Equity Long Short Strategy (the “Strategy”) is a managed futures program offered by an exclusive partnership between Turk Capital, LLC and TrimTabs Investment Research, Inc. Trading is based solely on the trading signals generated by the TrimTabs Demand Index (the “TTDI”). The TTDI is a proprietary regression model that uses 21 public and proprietary flow and sentiment variables for market timing. These variables are normalized into scores in order to create the TTDI and to generate signals for the Strategy. Based on levels of the TTDI, investors will benefit from one of four potential S&P 500 Future positions: 100% short, flat, 100% long or 200% long. The Strategy does not employ any other positions or use any other instruments. Investors benefit from TrimTabs’ unique focus on equity market liquidity—as opposed to fundamental or technical analysis—and the market timing signals this focus generates.

PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

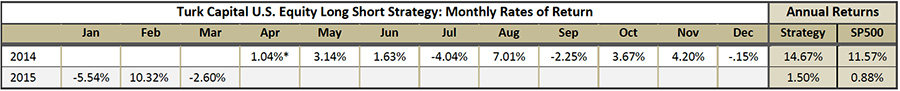

SP500 results are based on the SPY (SPDR S&P500 ETF). Results take into account a 1% Management and 20% Incentive Fees as well as actual execution costs.*Results from April 2014 are from a proprietary trading account and are inclusive of pro forma fees. Net performance is not reduced by commissions on open positions for rate of return calculations. ROR is calculated in accordance with the Modified OAT method. Accounts opening or closing during a month are generally excluded from ROR calculations.

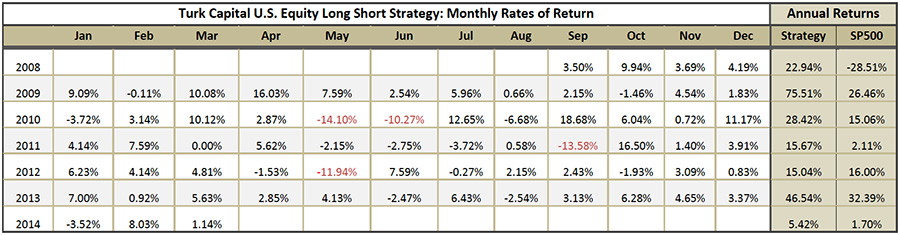

SP500 results are based on the SPY (SPDR S&P500 ETF). Results take into account a 1% Management and 20% Incentive Fees as well as actual execution costs.*Results from April 2014 are from a proprietary trading account and are inclusive of pro forma fees. Net performance is not reduced by commissions on open positions for rate of return calculations. ROR is calculated in accordance with the Modified OAT method. Accounts opening or closing during a month are generally excluded from ROR calculations. TrimTabs has been generating trading signals based on the Demand Index since September 3, 2008. The following hypothetical results are calculated by adjusting trading results that would have been realized for fees since September 3, 2008.

All results are based on the SPY (SPDR S&P500 ETF). Sharpe Ratio calculations include back tested performance data from 2008. Results are based off of 1% Management and 20% Incentive Fees as well as .20 % p.a. execution costs. Hypothetical performance assumes trades are executed at a price equal to the average of the volume weighted average price on the day the signal would have been received and the prior day’s closing price.

All results are based on the SPY (SPDR S&P500 ETF). Sharpe Ratio calculations include back tested performance data from 2008. Results are based off of 1% Management and 20% Incentive Fees as well as .20 % p.a. execution costs. Hypothetical performance assumes trades are executed at a price equal to the average of the volume weighted average price on the day the signal would have been received and the prior day’s closing price. Sharpe Ratio: 1.55 (.37 for the SP500). Worst Monthly Loss:-14.10% (-16.66% SP500). Largest Drawdown: -22.92% (-29.89% SP500).

PURSUANT TO AN EXEMPTION FROM THE COMMODITY FUTURES TRADING COMMISSION IN CONNECTION WITH ACCOUNTS OF QUALIFIED ELIGIBLE PERSONS, THIS BROCHURE OR ACCOUNT DOCUMENT IS NOT REQUIRED TO, AND HAS NOT BEEN, FILED WITH THE COMMISSION. THE COMMODITY FUTURES TRADING COMMSSION DOES NOT PASS UPON THE MERITS OF PARTICIPATING IN A TRADING PROGRAM OR UPON THE ADEQUACY OR ACCURACY OF COMMODITY TRADING ADVISOR DISCLOSURE. CONSEQUENTLY, THE COMMODITY FUTURES TRADING COMMISSION HAS NOT REVIEWED OR APPROVED THIS TRADING PROGRAM OR THIS BROCHURE OR THIS ACCOUNT DOCUMENT. THIS IS NOT AN OFFERING OR THE SOLICIATION OF AN OFFER TO INVEST IN THE TURK CAPITAL U.S. EQUITY LONG SHORT STRATEGY. ANY SUCH OFFER OR SOLICITATION WILL ONLY BE MADE TO QUALIFIED INVESTORS BY MEANS OF AN INVESTMENT MANAGEMENT AGREEMENT AND ONLY WHERE ALLOWED BY APPLICABLE LAW. AN INVESTMENT IN THE STRATEGY IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK.

THE PERFORMANCE INFORMATION HAS NOT BEEN INDEPENDENTLY VERIFIED BUT IT IS BELIEVED BY TURK CAPITAL, LLC TO BE CORRECT.