I.Qualified Eligible Person Representation

All parties must check a box below and represent that they are a qualified eligible person. Certain parties must meet the Portfolio Requirement to qualify as a qualified eligible person. The Portfolio Requirement means that a person:

a) Owns securities (including pool participations) of issuers not affiliated with the Client and other investments with an aggregate market value of at least $2,000,000; or

b)Has on deposit with a futures commission merchant at least $200,000 in exchange-specified initial margin and option premiums for commodity interest transactions; or

c) Owns a portfolio comprised of a proportionate combination of the funds of (a) and (b) (e.g., $1,000,000 in securities and $100,000 in margin and premium).

QUALIFICATIONS

For Individuals:

a)The Client either (i) satisfies the Portfolio Requirement or (ii) is a “Qualified Purchaser as defined in Section II below.

b)The Client either: (i) satisfies the Portfolio Requirement, or (ii) is a “Qualified Purchaser” as defined in Section II below.

c) The Client is a “knowledgeable employee” of the Company or its affiliates as defined in Sec. 270.3c-5 of the Commodity Exchange Regulations.

d)A Non-United States person.

e)Any person who acquires an interest in an exempt account by gift, bequest or pursuant to an agreement relating to a legal separation or divorce from

For Corporations, Partnerships or Limited Liability Companies:

f) The Client, other than a pool, has total assets in excess of $5,000,000, was not formed for the specific purpose of opening an exempt account, and it either: satisfies the Portfolio Requirement or (ii) is a “Qualified Purchaser as defined in Section II below.

g)The Client was not formed for the specific purpose of opening an exempt account, and is: (i) a futures commission merchant registered pursuant to Section 4(d) of the Commodity Exchange Act, as amended (“CEA”); (ii) a commodity trading advisor, or a principal thereof, registered pursuant to Section 4m of the CEA who has either been registered and active as such for two years or provides commodity interest trading advice to commodity accounts which, in the aggregate, have total assets in excess of $5,000,000 deposited at one or more futures commission merchants; (iii) a commodity pool operator, or a principal thereof, registered pursuant to Section 4m of the Act who either has been registered and active as such for two years or operates pools which, in the aggregate, have total assets in excess of $5,000,000; (iv) a broker or dealer registered pursuant to section 15 of the Securities Exchange Act of 1934, or a principal thereof; or (v) an investment adviser registered pursuant to section 203 of the Investment Advisers Act of 1940 or pursuant to the laws of any state, or a principal thereof, provided that the investment adviser has either been registered and active as such for two year or provides securities investment advice to securities accounts which, in the aggregate, have total assets in excess of $5,000,000 deposited at one or more registered securities brokers; (vi) an investment company registered under the Investment Company Act or a business development company as defined in section 2(a)(48) of such Act, or (vii) a private business development company as defined in section 202(a)22 of the Investment Advisers Act; (viii) a retail foreign exchange dealer registered pursuant to section 2(c)(2)(B)(k)(II)(gg) of the CEA, or a principal thereof; (ix) a swap dealer registered pursuant to section 4s(a)(1) of the CEA, or a principal thereof.

h)The Client is a pool that has total assets in excess of $5,000,000, was not formed for the specific purpose of opening an exempt account, satisfies the Portfolio Requirement, and its purchase is directed by a “qualified eligible person.”

i) All of the Client’s equity owners, unit owners and participants are “qualified eligible persons.”

j) The Client is a non-United States person.

For Trusts:

k)The Client has total assets in excess of $5,000,000, it was not formed for the specific purpose of opening an exempt account, whose participation in the exempt account is directed by a “qualified eligible person, it either: satisfies the Portfolio Requirement or (ii) is a “Qualified Purchaser is defined in Section II below.

l) The Client is a revocable trust which may be amended or revoked at any time by the grantors thereof and all of the settlors are “qualified eligible persons.”

For Employee Benefit Plans (including Keogh Plans):

m) The Client is an employee benefit plan within the meaning of ERISA, the investment decision is made by a plan fiduciary, as defined in section 3(21) of such Act, which is a bank, savings and loan association, insurance company, or registered investment adviser, the Client either: satisfies the Portfolio Requirement or (ii) is a “Qualified Purchaser is defined in Section II below.

n)The Client is an employee benefit plan within the meaning of ERISA, it has $5,000,000 and the Client either: satisfies the Portfolio Requirement or (ii) is a “Qualified Purchaser as defined in Section II below.

o)The Client is a self-directed plan directed by a participant who is a “qualified eligible person.”

p)The beneficiary of the Client is a “qualified eligible person” under paragraphs (a) or (b) above.

For Other Tax-Exempt Entities:

q)The Client is an organization described in section 501(c)(3) of the Internal Revenue Code with total assets in excess of $5,000,000, was not formed for the specific purpose of opening an exempt account, and it either: satisfies the Portfolio Requirement or (ii) is a “Qualified Purchaser is defined in Section II below, or (iii) the trustee or other person authorized to make investment decisions with respect to the organization, and the person who has established the organization, is a qualified eligible person.

r) The Client is a plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan has total assets in excess of $5,000,000 and it either: satisfies the Portfolio Requirement or (ii) is a “Qualified Purchaser is defined in Section II below.

For Banks:

s) The Client a bank as defined in section 3(a)(2) of the Securities Act of 1933 (the “Securities Act”) or any savings and loan association or other institution as defined in section 3(a)(5)(A) of the Securities Act acting for its own account or for the account of a qualified eligible person and it either: (i) satisfies the Portfolio Requirement or (ii) is a “Qualified Purchaser as defined in Section II below.

For Insurance Companies:

t) The Client is an insurance company as defined in section 2(13) of the Securities Act acting for its own account or for the account of a qualified eligible person, and it either: satisfies the Portfolio Requirement or (ii) is a “Qualified Purchaser as defined in Section II below.

u)The Client is an insurance company separate account, with total assets in excess of $5,000,000, not formed for the specific purpose of opening an exempt account, and whose investment in the exempt account is directed by a “qualified eligible person”, and it either: (i) satisfies the Portfolio Requirement or (ii) is a “Qualified Purchaser as defined in Section II below.

II. Qualified Purchaser

The following instructions are designed to assist prospective investors in determining whether they are “Qualified Purchasers.” Please note that it is not necessary to be a “Qualified Purchaser” to invest. Rather, “Qualified Purchaser” status is just one method of qualifying as a “qualified eligible persons” under CFTC Regulation 4.7 and thus being eligible to open an account.

An individual Client is a “Qualified Purchaser” if”

a)The Client owns not less than $5,000,000 in investments;”

b)The Client, acting for its own account or the accounts of other qualified purchasers, owns and invests on a discretionary basis, not less than $25,000,000 in investments.

A Client which is not an individual is a “Qualified Purchaser” if:

c)The Client is a company, partnership, trust or other entity that owns not less than $5,000,000 in investments and that is owned directly or indirectly by or for 2 or more natural persons who are related as siblings or spouse (including former spouses), or direct lineal descendants by birth or adoption, spouses of such persons, the estates of such persons, or foundations, charitable organizations or trusts established by or for the benefit of such persons, and was not formed for the specific purpose of opening an account; or

d)The Client is a trust other than in subsection (c) that was not formed for the specific purpose of acquiring the securities offered, as to which the trustee or other person authorized to make decisions with respect to the trust, and each settler or other person who has contributed assets to the trust, is a person described in clause (a) or (b), or is a “knowledgeable employee”; or

e)The Client is a company, partnership, trust or other entity that was not formed for the specific purpose of acquiring the securities being offered, acts for its own account or the accounts of other “qualified purchasers” and in the aggregate owns and invests on a discretionary basis not less than $25,000,000 in investments; or

f) The Client is a “qualified institutional buyer;” or

g)The Client is a company, partnership or other entity whose securities are beneficially owned exclusively by “qualified purchasers;”

h)The Client is a company, partnership or other entity whose securities are beneficially owned exclusively by “knowledgeable employees.”

If the Client is a company, partnership, trust or other entity that, but for the exception provided in Section 3(c)(1) or Section 3(c)(7) of the Investment Company Act of 1940 would be an investment company and was in existence prior to April 30, 1996, all of the pre-April 30, 1996 beneficial owners of the outstanding securities of the Client must consent to the Client being treated as a qualified purchaser for purposes of opening an account.

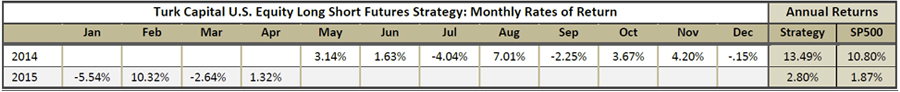

SP500 results are based on the SPY (SPDR S&P500 ETF). Results take into account a 1% Management and 20% Incentive Fees as well as actual execution costs. Net performance is not reduced by commissions on open positions for rate of return calculations. ROR is calculated in accordance with the Modified OAT method. Accounts opening or closing during a month are generally excluded from ROR calculations.

SP500 results are based on the SPY (SPDR S&P500 ETF). Results take into account a 1% Management and 20% Incentive Fees as well as actual execution costs. Net performance is not reduced by commissions on open positions for rate of return calculations. ROR is calculated in accordance with the Modified OAT method. Accounts opening or closing during a month are generally excluded from ROR calculations.